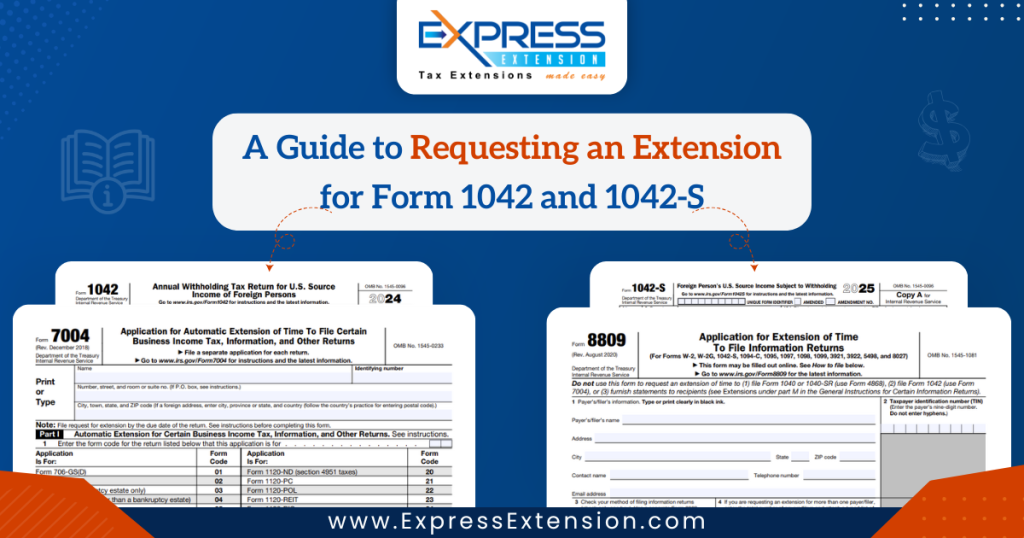

A Guide to Requesting an Extension for Form 1042 and 1042-S

reading time: 15 minute(s)

Filing taxes for foreign individuals comes with its own set of deadlines—and missing them isn’t an option. If you’re in the thick of Form 1042 and 1042-S season, you know how critical it is to get every detail right while staying ahead of key dates. Unlike 1099s and W-2s, these forms deal with withholding for non-U.S. individuals, adding layers of complexity that require precision.

But what happens if you’re running out of time? The good news: You can request an extension. Whether you need extra time to reconcile records, confirm withholding amounts, or finalize documentation, an extension gives you the breathing room to file accurately and avoid penalties.

Here’s what you need to know about securing more time and keeping your compliance on track.

Form 1042 and Form 1042-S – An Overview

Before diving into extensions, it’s important to understand the difference between Form 1042 and Form 1042-S.

- Form 1042: This is used by withholding agents (such as businesses or financial institutions) to report and pay the tax withheld on income paid to foreign individuals and entities.

- Form 1042-S: This form is used to report the income paid to foreign persons, along with the amount of tax that was withheld from that income. Each foreign individual or entity that received payments will get a Form 1042-S to report their share of income.

Both of these forms play a key role in ensuring that taxes are properly withheld and reported to the IRS for foreign transactions. While these forms have different purposes, they are both subject to similar filing deadline, i.e., March 17.

Key Differences Between Form 1042 and Form 1042-S

| Criteria | Form 1042 | Form 1042-S |

| Purpose | Reports total tax withheld on payments to foreign persons. | Reports individual payments and tax withheld for each foreign recipient. |

| Who Files | Withholding agents (businesses, financial institutions). | Withholding agents for each foreign individual. |

| Who Receives | Filed with the IRS only. | Filed with the IRS and copy provided to the foreign individual. |

| Reporting Type | Summary of total taxes withheld for the year. | Detailed report of income and tax withheld for each individual. |

Why Filing an Extension is Important

The IRS sets strict due dates for Form 1042 and Form 1042-S. If you fail to meet these deadlines, you may be subject to penalties. For most businesses, the filing deadline is March 17, 2025, for the 2024 tax year. Failing to meet this deadline can result in penalties, which increase with the length of the delay. This is when extension comes into play!

It grants you more time to file the forms without facing penalties for late submission. However, it’s crucial to remember that an extension only applies to the filing deadline— it does not extend your tax payment deadline.

How to Request an Extension for Forms 1042 and 1042-S

If you need more time to file Forms 1042 and 1042-S, the IRS does allow you to request an extension. However, it’s important to understand that each form requires a different extension process. Here’s a breakdown of the options:

- Form 1042-S Extension

- If you need more time to file Form 1042-S, you can request an extension by filing Form 8809.

- Upon filing an extension for 1042-S, you can secure an automatic extension of 30 days to file your tax return.

- Form 1042 Extension

- If you need more time to file Form 1042, you can request an extension by filing Form 7004.

- Upon filing an extension for 1042, you can secure an automatic extension of 6-month extension to file your tax return.

Key Considerations When Filing an Extension

There are a few things that need to be ensured to avoid the common mistakes and delays:

- Accurate Information: Ensure your business name, EIN, and other details match IRS records to avoid processing issues.

- Know the Correct Extension Form: Choose the correct extension form to extend your original tax return deadline. Selecting the wrong form may result in a rejected request.

- Use the Correct Form Code: Each extension form requires a specific code. Entering an incorrect code can delay processing or lead to rejection.

Late Filing Penalties and How to Avoid Them

Even if you request an extension, you must file Form 1042 and Form 1042-S by the extended deadline. If you miss the deadline, the IRS can impose penalties for late filing, which can add up quickly. The penalty is usually a percentage of the tax due, and the longer the delay, the higher the penalty.

To avoid these penalties, be sure to:

- Request the extension on time by submitting the respective forms by March 17.

- Pay any taxes owed by March 17 to avoid interest and penalties.

- File by the extended deadline to avoid additional late fees.

Conclusion

Filing Forms 1042 and 1042-S requires attention to detail and strict adherence to deadlines. To avoid penalties, it’s essential to file on time with accurate information. TaxBandits, our sister product, simplifies this process, providing an efficient, secure platform for e-filing both Form 1042 and Form 1042-S. With built-in validations and real-time status tracking, you can confidently complete your filings while ensuring compliance.

But if time is running short, you still have options. ExpressExtension allows you to request an extension quickly and securely, giving you the extra time needed to file correctly. Our e-filing platform offers automatic approval for Form 1042 and 1042-S extensions, helping you avoid last-minute stress and potential penalties. With advanced security and AI-powered assistance, we guide you through the process seamlessly.

Stay ahead of your deadlines with TaxBandits, and if you need more time, let ExpressExtension help you secure an extension with ease.

Leave a Comment