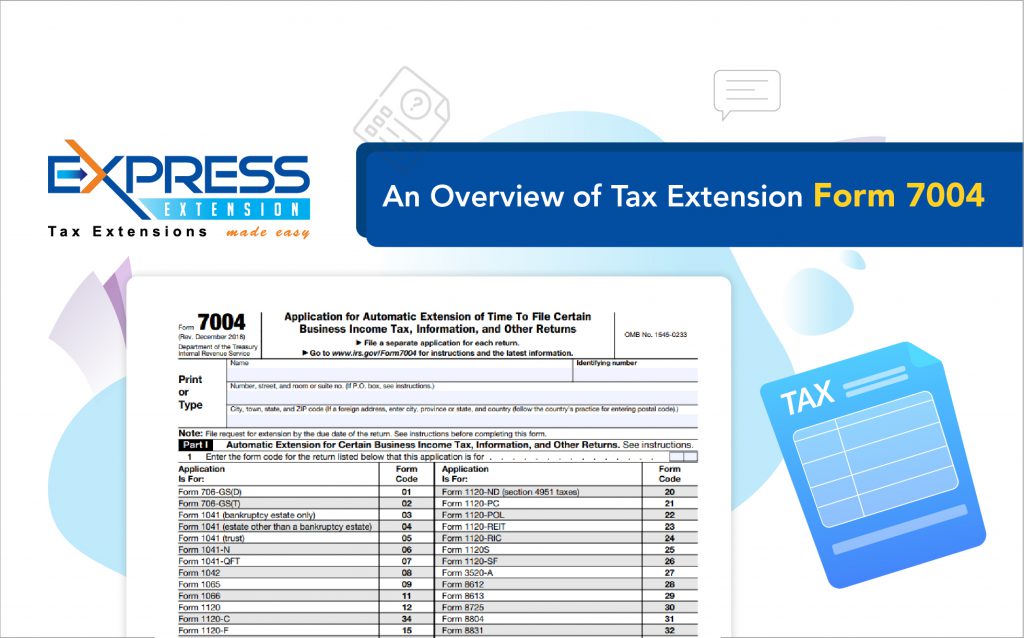

An Overview of Tax Extension Form 7004

reading time: 11 minute(s)

There is so much misinformation out there about IRS tax extensions!

For one, many people have the impression that the IRS frowns upon individuals or businesses that file an extension or that they will hold a grudge against them.

This is a myth! The IRS doesn’t have any reason to scrutinize anyone who files an extension.

The IRS doesn’t even require any explanation for why you chose to file most extensions, like Form 7004. Filing an extension for your upcoming business income taxes could be a huge relief for you and your business for the 2021 tax year!

Filing a Form 7004 is a simple and straightforward process, this is all there is to it!

Getting Started: Form 7004

First things first, before you get into the specifics in Part 1 and 2 of the form, you will need to enter your basic business information. This includes your legal name, address, and identifying number.

Form 7004, Part I

In Part I, all you need to do is indicate the form that you wish to extend, then enter the code on Line 1.

For example, if your business wants an extension to file Form 1065, enter the corresponding code 09. If you want to file an extension for Form 1120-S, enter the corresponding code 25.

That’s all there is to it! Just remember, you can’t file one “blanket” extension. The IRS requires that you file a separate extension form for each information return that you need an extension for.

For example, if you are part-owner of a partnership, and also need an extension on your personal income tax return, you must file a Form 7004 for the partnership, and Form 4868 separately for your personal income tax return.

Form 7004, Part II

Now we get down to the specifics of Form 7004, Part II.

On Line 2, you should check the box only if you are a foreign corporation, otherwise, you can skip it.

Line 3 asks whether your organization is part of a larger parent group, if so, you will need to check the box and attach a statement listing all the members of the group. This statement must include the name, address, and EIN of each member.

If your business is treated as a partnership or corporation under 1.6081-5 you can indicate this by checking the box on Line 4.

Under this regulation, foreign corporations and partnerships are entitled to additional time to file, these organizations have until the 6th month following the end of the tax year. After this point, they can file an extension 7004 for an additional 2-3 months.

On Line 5a, you will indicate that your business is operating on a calendar year, if not you will need to enter the start and end dates for your tax year.

If your tax year was shorter than 12 months, you will need to indicate why this is on Line 5b by checking the corresponding box. For example, you may have changed your method of accounting or if your business closed, you may be filing your last return.

On Line 6 you should enter the estimated amount of taxes that you expect to owe at the end of the year, including any non-refundable tax credits.

Enter all tax payments and nonrefundable credits on Line 7.

Remember, the Form 7004 extension applies only to your information return, not your tax payment. On Line 8 enter your balance due to the IRS. To get this total, subtract Line 7 from Line 6.

That’s all there is to it, that’s the Form 7004 from start to finish.

E-filing Your 2021 Form 7004

Now, when it comes to filing, filing Form 7004 electronically will save you time and you will know instantly that your extension form made it to the IRS. Plus, you will receive updates. If your Form 7004 is rejected, you can easily correct the error and retransmit at no additional cost.

To get started filing today, create your free ExpressExtension account!

Want to know how to e-file 2021 Form 7004 using ExpressExtension?

Watch this video to see the e-filing process in action!

Leave a Comment