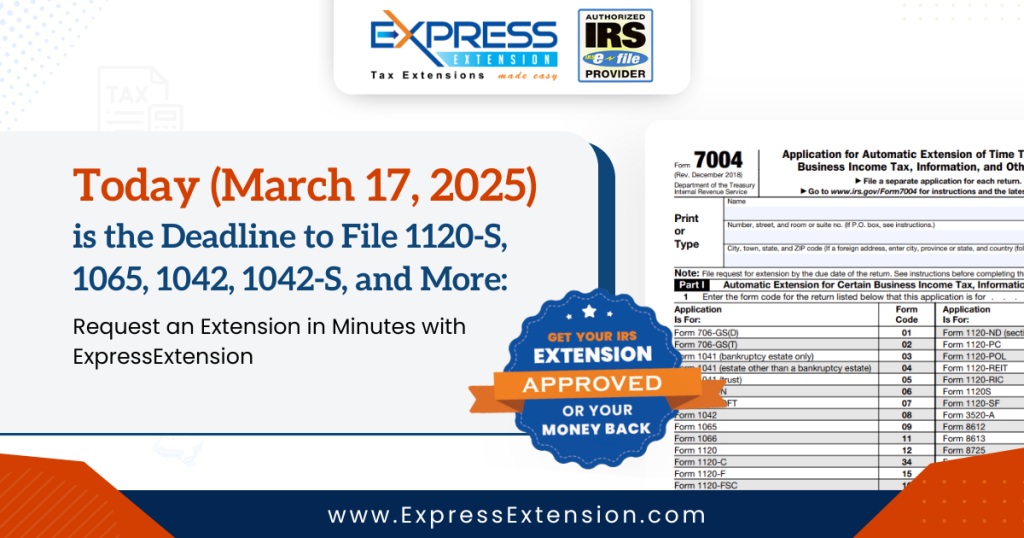

Today (March 17, 2025) is the Deadline to File 1120-S & 1065: File Your 7004 Extension in Minutes

reading time: 14 minute(s)

The countdown is on: Don’t let the tax deadline slip through your fingers!

Today (March 17, 2025) isn’t just another day—it’s the critical deadline for filing key IRS forms like 1120-S, 1065, 1042, and more. If you miss it, you could face heavy penalties, added stress, and serious compliance issues. For businesses and taxpayers alike, this is the time to act.

But don’t worry—you don’t have to rush through the filing process or risk making last-minute mistakes. ExpressExtension is here to make the extension filing process quick, easy, and stress-free. With ExpressExtension, you can file your 7004 extension in just minutes, securing that extra time you need while avoiding the chaos of the approaching midnight deadline.

But don’t wait until it’s too late. File your extension before the clock runs out to stay compliant with the IRS and avoid unnecessary penalties.

Who Must Meet This Important Deadline?

If your business falls under certain federal tax classifications, today is the day you need to file your tax returns with the IRS. Here’s who needs to meet this critical deadline:

- S-Corporations filing Form 1120-S

- Partnerships filing Form 1065

- Withholding agents subject to foreign payment reporting must file Form 1042

In addition to these, certain other important tax returns are also due today:

- Form 1065-B

- Form 3520-A

- Form 8612

- Form 8613

- Form 8804

- Form 1066

If your business is required to file any of the above, make sure to get it done today to avoid facing potential penalties.

Need More Time? File an Extension

Feeling like there’s not enough time to get everything in order? Don’t worry—if you need more time to file your tax return, filing for an extension is a smart move. Filing an extension doesn’t just give you a bit of breathing room—it helps you stay compliant with the IRS while ensuring you file your return correctly without rushing through potential errors.

For instance, if you’re an S-Corp and need more time to file your Form 1120-S, you can file Form 7004 to extend your deadline. By submitting this form, you automatically get a six-month extension, giving you the extra time you need to complete your tax return accurately. It’s not just for 1120-S forms; businesses of all types use Form 7004 to extend their filing deadlines.

Things to Check When Filing an Extension

There are a few things to be checked before filing an extension to avoid common mistakes and errors:

- Verify Your Business Information:

Ensure that your business name, EIN, and other details are accurate and match the IRS records. Incorrect or mismatched information could delay the processing of your extension request. - Request Correct Extension Form:

Choose the correct extension form to extend your original tax return deadline. Selecting the wrong form for your extension can result in your request being rejected, so double-check before submitting. - Enter the Correct Form Code:Every extension form has a specific code. It’s essential to enter the right code to avoid any processing delays or the possibility of rejection.

States With Business Tax Deadline Today

In addition to the federal tax extension deadline, several states have specific deadlines for filing an extension. If you’re located in one of the following states and need to extend your tax return deadline, today, March 17, 2025, is the deadline to request a business tax extension. Make sure to file on time to avoid penalties:

While some states accept the federal extension, others require a separate state tax extension. So, understand the state-specific requirements and ensure you’re meeting the filing deadline for these states to avoid any last-minute issues.

What Happens If You Miss the Deadline?

If you fail to file your original tax return on or before the deadline, including extensions, you’ll face hefty penalties from the IRS. The penalties vary depending on your filing tax form and whether you miss the filing or payment deadline.

- Late Filing Penalties:

For example, if you miss the deadline for Form 1120-S and the extension deadline, the IRS imposes a 5% penalty per month, up to 5 months, on the amount due. - Late Payment Penalties:

If you don’t pay your tax due by the deadline, the IRS will impose penalties on the unpaid balance. The penalty is usually a percentage of the tax due, and the longer the delay, the higher the penalty.

To avoid these penalties, make sure to file your extensions correctly and pay any outstanding taxes before the original deadline.

Act Now! Meet This Deadline With ExpressExtension

Don’t wait until the last minute — ExpressExtension is here to help you file your extensions quickly and easily.

ExpressExtension allows you to e-file your extensions with guaranteed IRS approval, ensuring you stay compliant without the hassle. The process is fast, secure, and reliable, so you can focus on other important tasks. If the IRS rejects your extension request due to some errors, you can fix the incorrect information and retransmit your extension to the IRS at no extra cost.

Act now to meet today’s deadline and avoid any unnecessary stress. File your extension in minutes with ExpressExtension!

Leave a Comment