Understanding IRS Form 7004 Codes: A Guide to Accurate Extension Filing

reading time: 18 minute(s)

Tax deadlines can sneak up on even the most organized businesses. But missing a filing deadline can lead to penalties, added stress, and potential complications with the IRS. Fortunately, Form 7004 offers a straightforward way for businesses to request more time.

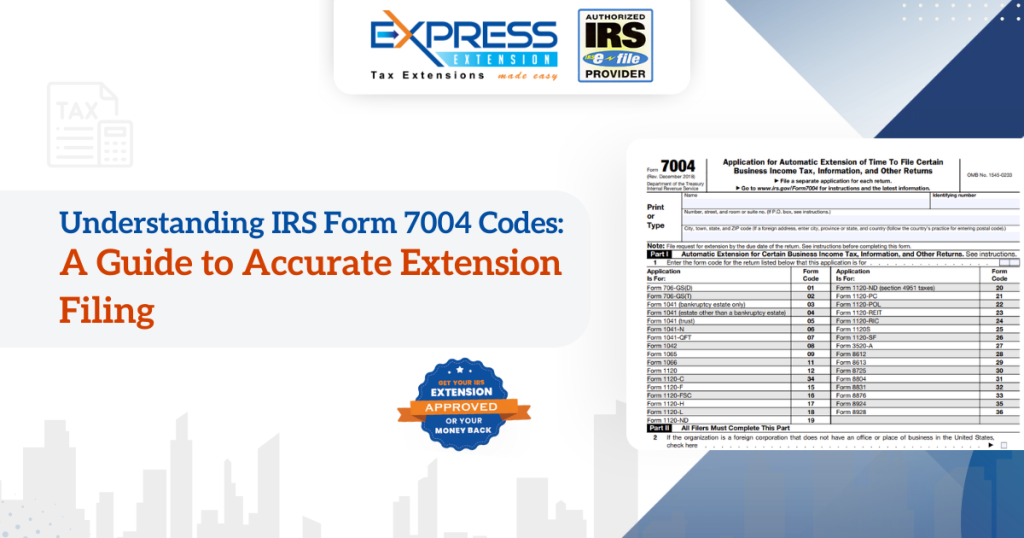

However, filing for an extension isn’t just about submitting the form—it’s about getting the details right, especially when it comes to Form 7004 codes. These numerical identifiers tell the IRS exactly which tax return your extension applies to, ensuring smooth processing and avoiding unnecessary delays.

In this guide, we’ll break down Form 7004 codes, explain their significance, and walk you through how to use them correctly. Whether you’re a corporation, partnership, or trust, understanding these codes is key to filing an extension the right way.

What are Form 7004 Codes?

Form 7004 codes are IRS-assigned numbers used to indicate the specific tax return for which an extension is being requested. When businesses file Form 7004, they must include the correct code that matches the tax return they need extra time for.

For instance, if a corporation needs an extension for Form 1120 (U.S. Corporation Income Tax Return), they must use Code 12 in Part I of Form 7004. This ensures that the IRS applies the extension to the correct return and processes it without confusion.

Now, let’s decode each Form 7004 code and identify who should use them.

Decoding Form 7004 Codes: Who Files What?

Below are the form codes for the respective returns listed below:

| Form 7004 Codes | Forms | Description |

| 01 | Form 706-GS(D) | Filed by trustees to report distributions subject to the Generation-Skipping Transfer Tax imposed on certain transfers to skip persons (such as grandchildren). |

| 02 | Form 706-GS(T) | Filed by trustees to report terminations of certain trusts subject to the Generation-Skipping Transfer Tax when trust assets are distributed. |

| 03 | Form 1041 (Bankruptcy Estate Only) | Filed by bankruptcy estates to report taxable income from the estate of an individual in bankruptcy proceedings under Chapter 7 or 11. |

| 04 | Form 1041 (Estate Other Than a Bankruptcy Estate) | Filed by estates of deceased individuals to report income earned after the owner’s death until the estate is fully distributed. |

| 05 | Form 1041 (Trust) | Filed by trusts to report income, deductions, and distributions to beneficiaries. |

| 06 | Form 1041-N | Filed by Alaska Native Settlement Trusts to report income and tax obligations specific to these entities. |

| 07 | Form 1041-QFT | Filed by Qualified Funeral Trusts to report income and taxes related to pre-need funeral arrangements. |

| 08 | Form 1042 | Filed by withholding agents to report U.S. source income paid to foreign persons and the taxes withheld. |

| 09 | Form 1065 | Filed by partnerships to report business income, deductions, and other tax-related items distributed to partners. |

| 11 | Form 1066 | Filed by Real Estate Mortgage Investment Conduits (REMICs) to report income, deductions, and distributions. |

| 12 | Form 1120 | Filed by corporations to report their taxable income and calculate tax liability. |

| 34 | Form 1120-C | Filed by cooperative associations to report income and deductions specific to cooperative organizations. |

| 15 | Form 1120-F | Filed by foreign corporations with income from U.S. sources. |

| 16 | Form 1120-FSC | Filed by Foreign Sales Corporations (FSCs) to report income and tax obligations related to export transactions. |

| 17 | Form 1120-H | Filed by homeowners associations that choose to be taxed under section 528. |

| 18 | Form 1120-L | Filed by life insurance companies to report taxable income and deductions. |

| 19 | Form 1120-ND | Filed for nuclear decommissioning funds, which hold assets set aside for decommissioning nuclear plants. |

| 20 | Form 1120-ND (Section 4951 Taxes) | Filed for certain excise taxes related to nuclear decommissioning funds. |

| 21 | Form 1120-PC | Filed by property and casualty insurance companies to report income, deductions, and tax liability. |

| 22 | Form 1120-POL | Filed by political organizations that have taxable income after allowable deductions. |

| 23 | Form 1120-REIT | Filed by Real Estate Investment Trusts (REITs) to report income and distributions to shareholders. |

| 24 | Form 1120-RIC | Filed by Regulated Investment Companies (RICs) such as mutual funds. |

| 25 | Form 1120S | Filed by S corporations to report income, deductions, and tax obligations. |

| 26 | Form 1120-SF | Filed for settlement funds created under Section 468B. |

| 27 | Form 3520-A | Filed by foreign trusts with U.S. owners to report trust activities. |

| 28 | Form 8612 | Filed to report excise tax on undistributed REIT income. |

| 29 | Form 8613 | Filed to report excise tax on undistributed RIC income. |

| 30 | Form 8725 | Filed for excise tax on greenmail transactions. |

| 31 | Form 8804 | Filed for partnership withholding tax under Section 1446. |

| 32 | Form 8831 | Filed to report excise taxes on excess REMIC residual interests. |

| 33 | Form 8876 | Filed for excise tax on structured settlement factoring transactions. |

| 35 | Form 8924 | Filed to report excise tax on transfers of geothermal or mineral interests. |

| 36 | Form 8928 | Filed to report certain excise taxes under Chapter 43. |

Importance of Form 7004 Codes in Streamlining Extension Requests

The Form 7004 codes play a vital role in the tax extension process, as they ensure the accurate identification and processing of extension requests for various tax returns. Here’s why these codes are crucial:

- Accurate Tax Return Identification: The Form 7004 codes specify which tax return is being extended. For instance, Code 12 is for Form 1120 (corporate tax return). By using the correct code, you indicate to the IRS which form needs additional time for filing.

- Prevention of Processing Errors: Using an incorrect code can result in the misapplication of your extension request, causing delays, potential rejections, or the need for additional clarification. Proper code usage minimizes the risk of errors, ensuring a smooth and timely process.

- Compliance Assurance: Identifying the applicable tax return with the right code helps ensure your business complies with IRS regulations. This reduces the chances of penalties or other issues related to filing extensions.

- Streamlined Filing Process: The use of Form 7004 codes simplifies the filing process, allowing the IRS to process extension requests automatically without manual intervention. This speeds up the approval of your extension and avoids unnecessary complications.

Final Thoughts

Understanding and using the correct Form 7004 codes is essential for businesses and tax professionals requesting an extension for their tax filings. These codes ensure your extension request is processed accurately, minimizing delays and penalties. Selecting the right code helps the IRS identify the correct tax return, streamlines the process, and reduces the risk of errors.

For businesses seeking an efficient and reliable way to handle tax filing extensions, ExpressExtension offers a straightforward solution for e-filing Form 7004. With ExpressExtension, you can easily and securely request extensions for a wide range of tax returns, ensuring compliance and peace of mind.

Leverage ExpressExtension’s intuitive interface to stay on top of your tax obligations and confidently file your extension today!

Leave a Comment