Filing a Business Income Tax Extension for a Corporation

reading time: 10 minute(s)

April is here, the flowers are blooming, pollen is coating everything as far as the eye can see, and oh, right…another round of business income taxes are due to the IRS.

While S-corporations, partnerships, and other business entities filed their business income taxes back on March 15, there are several different forms for other business entities that must be filed on April 15, 2022.

The most common forms due to the IRS on April 15, 2022 is the 1041, and the Form 1120 for corporations. So, if you are operating a corporation or an organization that is taxed like a corporation by the IRS, stay tuned, this article is for you.

How does the IRS define a corporation?

A corporation is a business entity that exists separately from its owners. The owners have a limited liability when it comes to the corporation. In many cases profits pass through shareholders who have purchased stocks. Additionally, a board of directors is elected to make major decisions.

What is Form 1120?

Form 1120 is the U.S. Corporation Income Tax Return. This form is used to report a variety of information regarding the annual income and operations of a corporation. This form should be filed by the 15th day of the fourth month following the close of the tax year.

For corporations operating on a calendar year, this is April 15, 2022.

Which Extension Form should Corporations File?

Form 7004 applies to business entities that are required to pay business income taxes and file an information return to the IRS. This is the extension form that corporations should file. Filing Form 7004 successfully grants corporations 6 additional months to complete their business income tax return.

The extension is automatic, meaning that the IRS doesn;t expect any reason or explanation as to why you need an extension. Simply complete the extension form accurately and before the deadline of your Form 1120, you are good to go!

Paper Filing vs. Electronic Filing

Electronic filing has many advantages, one of them being that it is the IRS preferred method.

Filing electronically allows filers to increase the security and accuracy of their tax extension filing. The reason that the IRS prefers e-filing to paper filing is because there are many benefits to using this method.

Did you know that 20% of paper filed tax returns have mistakes? That’s a pretty high percentage when compared to electronic forms. Only 1% of these contain errors.

If that isn’t reason enough, consider security. Placing your sensitive information in an envelope and sending it via mail just isn’t the safest option, especially if you have included a tax payment.

Making your tax payment using electronic funds transfer is much safer, and you will know instantly that the payment has been received by the IRS, plus you can schedule your payment.

In addition to improved security, electronic filing allows for quicker processing of your extension and the opportunity for instant approval.

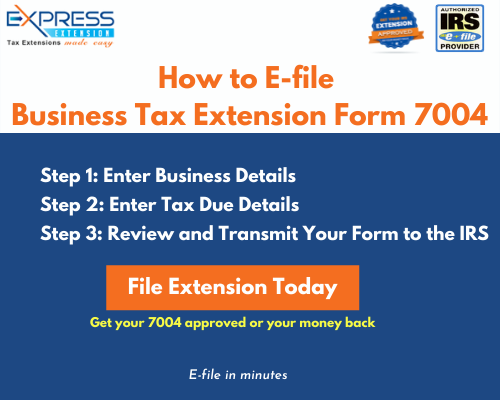

How to E-file 7004 with ExpressExtension

E-filing your tax extension has never been simpler! You can file your tax return by following these simple steps:

- Create/sign in to your ExpressExtension account

- Select the extension you want to file (7004)

- Enter the form information

- Make a secure tax payment if desired

- Review and transmit Form 7004 to the IRS

Are you ready to start filing your Form 7004 with ExpressExtension? Not only do we offer a fast and easy filing process, we also offer our Express Guarantee. This means we guarantee your IRS approval or your money back! Learn more about the terms of our Express Guarantee here!

Leave a Comment