Filing an Extension for Trusts and Estates Tax Form 1041

reading time: 8 minute(s)

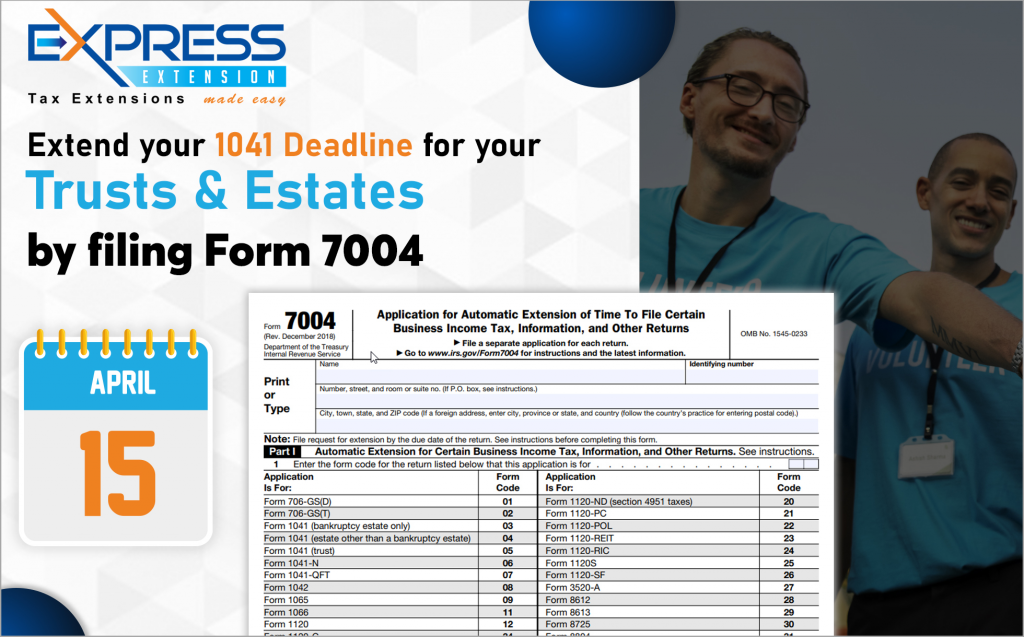

One of the more complex and intimidating business income tax returns that is due for many filers on April 15, 2021 is the Form 1041 for trusts and estates. Understandably, fiduciaries that are required to file this form may need additional time to complete this tax return.

For those that are seeking more time, filing a tax extension is the best way to proceed and avoid penalties.

Here is a guide for filing an extension for your Form 1041.

What is Form 1041?

The Form 1041 is the U.S. Income Tax Return for Estates and Trusts. This form must be filed by fiduciaries or joint fiduciaries of all domestic trusts and estates. The information reported on this form describes gains, losses, and deductions that were made to or by the trust or estate during the tax year to the IRS.

Fiduciaries of the following types of estates and trusts are required to file Form 1041.

- A Decedent’s estate with gross income of $600 or more

- Domestic Trusts taxable under section 641

- Grantor Type Trusts

- Alaska Native Settlement Trusts

- Bankruptcy Estates

- Charitable Remainder Trusts

- Common Trust Funds

- Electing Small Business Trusts

- Pooled Income Funds

- Qualified Funeral Trusts

- Qualified Settlement Funds

- Widely Held Fixed Investment Trusts

What is a Fiduciary?

A fiduciary is an individual or organization that acts on behalf of another person or organization. This responsible party is legally required to act in the best interest of the estate or trust that they represent. The fiduciary may also be referred to a trustee, administrator, or executor.

When is Form 1041 due to the IRS?

As a general rule by the IRS, the deadline for filing form 1041 falls on the 15th day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this date falls on April 15, 2021.

How do I extend this 1041 deadline?

You can extend your Form 1041 deadline fairly easily with the Form 7004. This is the Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.

The Form 7004 must be filed with the IRS on or before the original deadline of the form you wish to extend. In this case, your extension must be submitted and completed by April 15, 2021.

Remember, the Form 7004 extension applies only to the business income tax return itself, all tax payments owed to the IRS must be made on the original filing deadline to avoid penalties and interest.

What information is needed to file Form 7004?

To file the Form 7004 successfully, the following information will be needed:

- Legal name

- Basic information concerning the estate or trust

- The EIN

- The business address

- Your estimated tax payment

Ready to start filing today to extend your April 15 deadline?

Get started now with ExpressExtension. E-file your Form 7004 in minutes and receive instant IRS updates on your extension. You can even make your tax payment while filing your extension. Plus, we offer an Express Guarantee.

Checkout this video to see how to extension Form 7004 for Form 1041!

Leave a Comment