What Partnerships Need to Know About Form 7004 for Tax Year 2020

reading time: 9 minute(s)

Your business has probably just wrapped up your year-end reporting, your W-2s and 1099-NECs have been distributed and submitted, and you are probably ready for a break from tax returns.

We understand! However, we want to remind you that your business income tax return deadlines aren’t as far away as you may hope!

If your business identifies as a partnership, your business income tax return is due to the IRS by March 15, 2021, if your business operates on a calendar year schedule.

We understand that 2020 has been a tough year for businesses of all sizes and types, if you need additional time to gather the necessary information for completing your tax return, there is an easy option, filing a Form 7004 Extension!

What is a Form 7004 Extension?

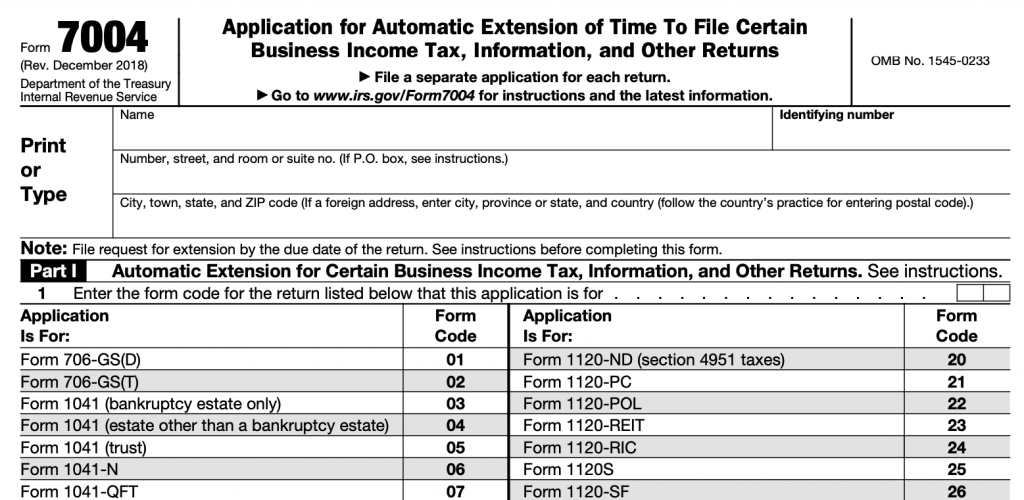

The Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, with the IRS, is exactly what it sounds like.

This is an automatic extension that allows businesses, including your partnership, to apply for up to an additional six months to file their tax returns.

Despite common misconceptions, the IRS doesn’t require you to provide a reason for filing your extension, nor do they hold any grudge against you for doing so.

Filing Requirements for a Partnership

Business entities that are classified as a partnership, must file the Form 1065, U.S Return of Partnership Income. This return reports the income, losses, gains, credits, deductions, and various other information related to the operation of the partnership.

In addition to the Form 1065, partnerships must attach a Schedule K-1 for each partner. The Schedule K-1 provides a summary of each partner’s shares within the partnership, as they must share this information on their personal income taxes.

What is the deadline for filing Form 1065?

The deadline for filing the Form 1065 is based on the partnerships’ fiscal year. If the business operates on a calendar year, then the deadline for filing is March 15, 2021.

All other partnerships are required to file with the IRS no later than the 15th day of the 4th month following the close of their tax year.

Extend your deadline with Form 7004

Understandably, many partnerships may need to delay their filing deadline in order to gather the needed information. To do this, partnerships should file a Form 7004.

As long as you file the Form 7004 with accurate information before your original filing deadline, the process will be simple and straightforward. The IRS doesn’t require you to provide any official reason for filing your extension and when filing electronically, you can receive instant IRS updates.

It is important to know that tax payments are not included in your extension. You will need to make a payment to the IRS regardless of whether or not you obtain an extension. With ExpressExtension, your e-filing process is easy and accurate.

Not only does our application make it possible for you to complete your Form 7004 in minutes, but if your form is rejected by the IRS, you are able to correct and retransmit it at no additional cost!

To get started, create a free ExpressExtension account today!

Leave a Comment